The pan-European Stoxx 600 index, which tracks the leading companies in the region, has plunged to its lowest level in 16 months

European stock markets fell on Monday morning, continuing a global selloff triggered by US President Donald Trump’s new tariffs that had already rattled Asian markets.

The pan-European Stoxx 600 index, which tracks the leading companies in the region, dropped more than 6% shortly after opening, hitting its lowest level since December 2023. Germany’s DAX tumbled nearly 10%, France’s CAC 40 slid 6.6%, and Italy’s FTSE MIB fell 5.7%.

In London, the FTSE 100 index of blue-chip stocks dropped 6%, marking its worst day since the early days of the Covid-19 pandemic in 2020. Every stock in the index was in the red one hour after the market opened.

Shares in defense firms and banks led the decline. German arms maker Rheinmetall plunged nearly 24%, and UK-based Rolls-Royce lost 12%. Mining and investment companies were also among the hardest hit.

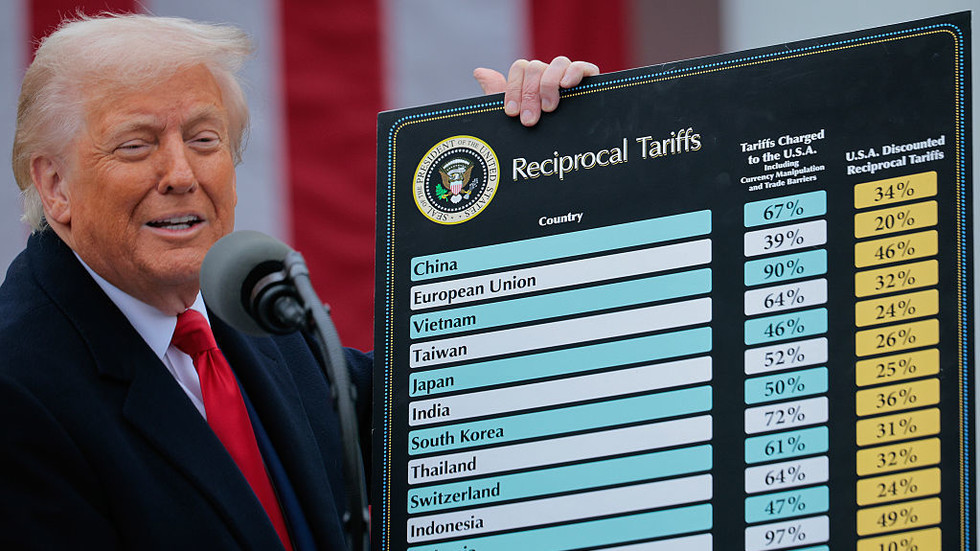

The rout followed Trump’s April 2 announcement of a 10% baseline tariff on all imports and additional “reciprocal” duties targeting dozens of countries with what he described as unfair trade practices. China responded with a 34% tariff on US goods. Several other nations condemned the move and pledged countermeasures. The EU, which faces a 20% tariff under Trump’s order, is set to begin talks with Washington later this week. European Commission President Ursula von der Leyen warned that if the talks fail, the bloc would take unified retaliatory action.

Trump defended the tariffs on Sunday, saying they are necessary to fix trade deficits with China, the EU, and others.

Market watchers, meanwhile, warned of prolonged turbulence as investors wait to see whether Trump will reverse course.

“This market is looking for concrete action, not talk of action,” Kathleen Brooks, research director at XTB, wrote in a note to The Guardian. “The best panacea for financial markets right now would be a pause or reversal from the US on its tariff program.”

UBS Global Wealth Management chief economist Paul Donovan added: “Over the weekend, US administration officials gave contradictory statements on trade taxes, causing investors to question the existence of a master plan… If the competence of policymaking is questioned, markets will worry that economic damage will be lasting.”

Asian markets also plunged on Monday. Japan’s Nikkei 225 fell to its lowest since October 2023, while indexes in China, Taiwan, South Korea, and Australia all traded in the red. US futures pointed to more losses after last week’s steep drop, when the S&P 500, Dow, and Nasdaq posted their worst results since the 2020 pandemic crash.

For more stories on economy & finance visit RT's business section

6 hours ago

1

6 hours ago

1

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·