Crude prices have dropped below $64 per barrel as US-China trade tensions fuel fears of a recession

Oil prices tumbled over 3% on Monday, deepening last week’s losses, as escalating US-China trade tensions heightened fears of a recession that could slash crude demand. Global benchmark Brent crude futures for June 2025 delivery plunged below $64 per barrel on London’s Intercontinental Exchange for the first time in four years, according to trading data.

Brent crude dropped $2.28 to $63.30 a barrel, while US West Texas Intermediate (WTI) fell $2.20 to $59.79, both hitting their lowest levels since April 2021.

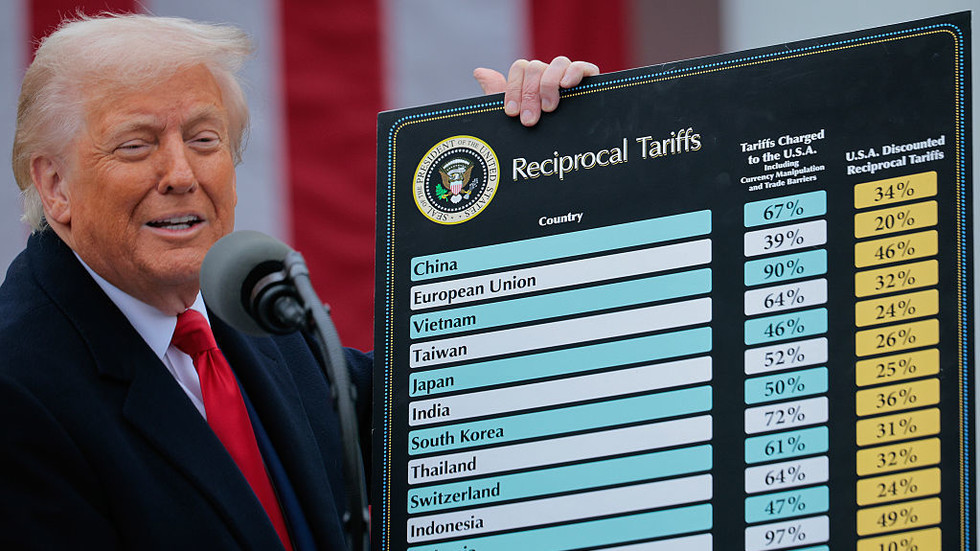

A perfect storm began to form late on Wednesday after US President Donald Trump unleashed a sweeping tariff onslaught, imposing blanket duties on all US trading partners, notably China, which is the world’s largest oil importer. Although energy was technically spared, markets reacted swiftly.

Oil prices nosedived 7% on Friday after China hit back at the US by slapping 34% import tariffs on American goods, intensifying the trade war and fueling recession fears among investors. Brent crude ended the week down 10.9%, while WTI sank 10.6%, marking one of the sharpest weekly losses in recent months.

“It’s hard to see a floor for crude unless the panic in the markets subsides and it’s hard to see that happening unless Trump says something to arrest snowballing fears over a global trade war and recession,” Vandana Hari, founder of oil market analysis company Vanda Insights, told Reuters.

The downturn in oil prices aligns with broader market turmoil as investors react to mounting economic uncertainties.

Although imports of oil, gas, and refined products were spared from Trump’s sweeping tariffs, analysts have noted that the broader policy shifts risk igniting inflation, slowing economic growth, and heightening trade tensions – factors that could further weigh on oil prices.

The ongoing slide in oil prices comes on the heels of an April 3 announcement from OPEC, revealing that eight OPEC+ member nations will fast-track production increases in May – raising output by 411,000 barrels per day, more than triple the previously planned 135,000 bpd.

Experts interviewed by TASS said the move reflects the current balance in the oil market. Despite falling prices, conditions are stable enough for OPEC to begin ramping up previously curbed production.

7 hours ago

1

7 hours ago

1

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·