China is starting to limit sales of key drone components to the US and Europe, Bloomberg reported.

Chinese producers of motors, batteries, and flight controllers are reportedly capping or stopping shipments, it cited sources as saying. Future license approvals may be based on what the parts will be used for, with Chinese manufacturers possibly required to report shipment plans.

China controls almost 80% of the commercial drone market, according to the Center for Strategic and International Studies.

Affected companies are said to be rushing to source alternate supplies.

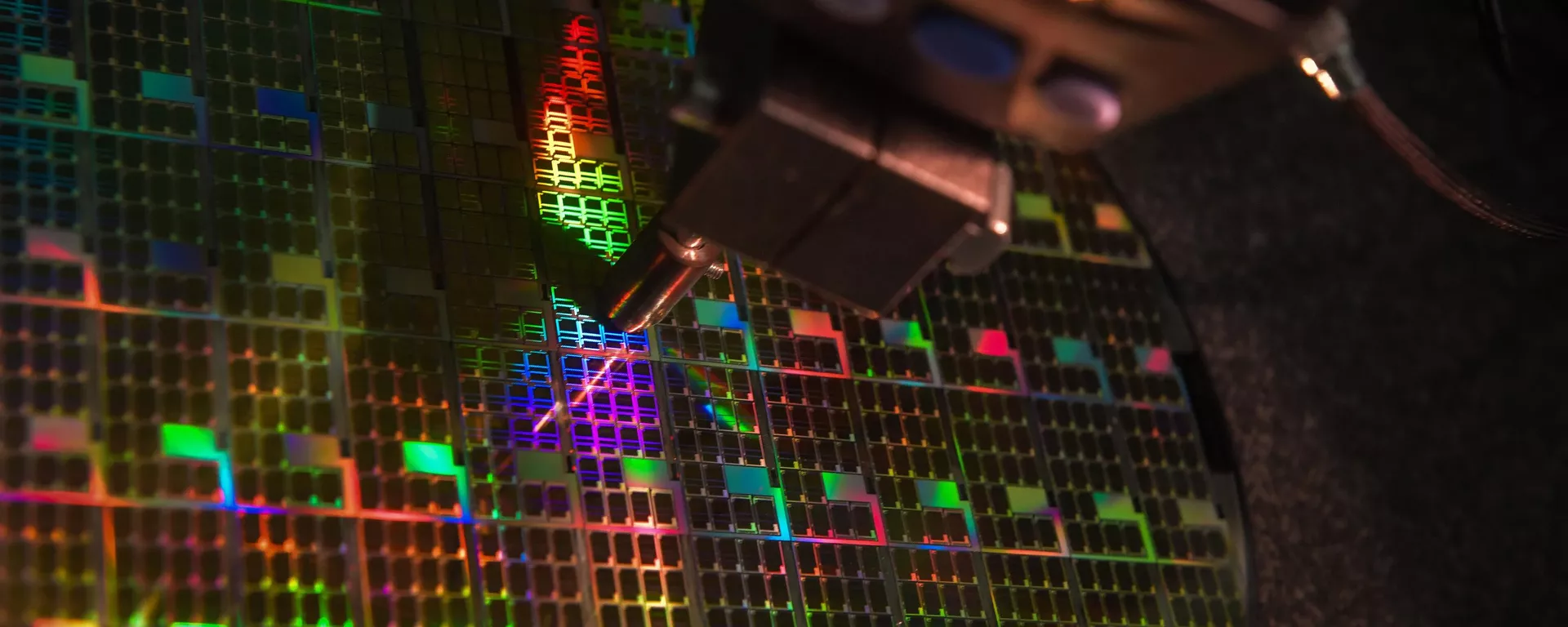

In another recent spiral of the US-China trade row, Washington imposed curbs in December on shipments to China of high bandwidth memory (HBM) chips; additional chipmaking and software tools; and chipmaking equipment made in third countries.

What Is the Fallout?

US restrictions violate market rules, disrupt supply chains, and could backfire on the American chip industry itself, China warned.

US consumers bear the brunt of the trade war through higher prices; aggregate real income plummets, per 2021 research by the National Bureau of Economic Research. Manufacturing, automotive, and tech companies are particularly at risk regarding revenue and supply chain dynamics, according to Strategy Risks market research firm.

President-elect Donald Trump, whose 2018 trade tariffs set off the trade war, has threatened to levy duties of 10% to 60% on Chinese goods with potential for epic-scale fallout.

4 months ago

28

4 months ago

28

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·