The slide on Wall Street has continued after the White House doubled down on tariffs against Beijing

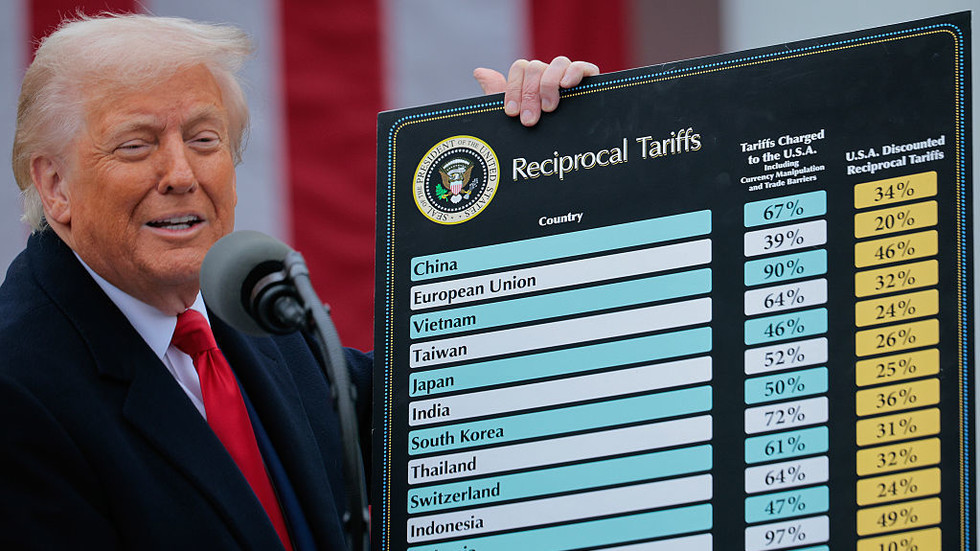

US stocks plunged sharply before recovering in another turbulent trading session on Monday. Markets continued to reel after President Donald Trump imposed tariffs on all imports and threatened even higher levies on China, escalating fears of a prolonged trade war.

The Dow Jones tumbled as much as 1,200 points intraday on Monday, or 3%, following back-to-back losses of over 1,500 points last week—marking the first time this has ever occurred on consecutive days. The S&P 500 dropped as much as 4.7% during the session, pushing it over 19% below its record high and briefly into bear market territory. The Nasdaq was down 3%, sinking further into bear market levels with a 23% decline from its peak.

Stocks attempted somewhat of a comeback later in the session, recovering most of the early losses. The Dow closed 349 points lower, with the S&P slightly in the red and the Nasdaq flat to positive.

On Saturday, Trump’s initial unilateral 10% tariff took effect, and hopes that over the weekend the administration would announce progress in negotiations were dashed. Instead, after Beijing retaliated, the president doubled down.

“If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th,” Trump wrote on Truth Social on Monday.

Business leaders have voiced growing concern over the White House’s aggressive trade stance.

“The president is losing the confidence of business leaders… we are heading for a self-induced, economic nuclear winter,” billionaire investor Bill Ackman wrote on X.

The market turmoil has spread globally. On Monday, Germany’s DAX dropped over 4%, and Hong Kong’s Hang Seng Index plunged 13%, its steepest drop since 1997. In commodities, US crude oil fell below $60 per barrel while Bitcoin slid under $77,000.

“Margin calls are going out as we speak,” FWDBONDS chief economist Chris Rupkey told CNBC. “For a third straight day investors in US equity markets have turned (a) huge thumbs down on the White House Liberation Day tariffs which have rocked Wall Street,” he added.

JPMorgan last week lifted the odds for a US and global recession to 60% by the end of the year, up from 40% previously.

5 hours ago

2

5 hours ago

2

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·