De Beers Group has amassed its largest diamond stockpile since the 2008 financial crisis, reflecting ongoing challenges in the luxury gemstone market, the Financial Times reported on Wednesday, citing the company’s press office.

The company, which dominates the $80 billion diamond jewelry industry, has seen inventory levels hover around $2 billion throughout 2024.

The slump in demand has been attributed to weak sales in China, growing competition from lab-grown alternatives, and the lingering impact of the Covid-19 pandemic, which disrupted global marriage rates.

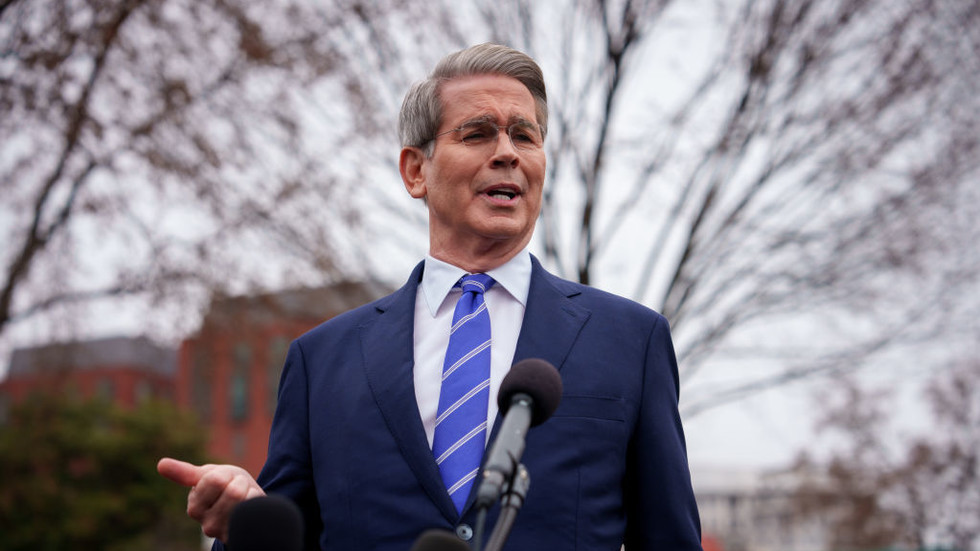

“It’s been a bad year for rough diamond sales,” CEO Al Cook said.

To mitigate the downturn, De Beers has cut production by around 20% compared to last year and reduced prices at its most recent auction of rough diamonds. These auctions involve selling uncut stones to a select group of certified buyers, known as sightholders, who are pivotal players in the diamond trade.

Revenue for De Beers fell to $2.2 billion in the first half of 2024, down from $2.8 billion in the same period of 2023. The decline comes as De Beers prepares to be spun off by its parent company, Anglo American, which promised to divest the diamond producer following a thwarted takeover bid by BHP. Anglo American CEO Duncan Wanblad has warned that the weak market complicates potential sale or public offering plans.

In response to market pressures, De Beers launched a marketing campaign in October highlighting the unique appeal of natural diamonds. Cook outlined plans for the company to invest in advertising and retail, expanding its network of global stores from 40 to 100.

Competition from lab-grown diamonds, which cost a fraction of natural stones, has intensified, particularly in the US, the world’s largest diamond market. However, Cook expressed optimism for a global recovery in 2024, citing recent credit card data showing increased US purchases of jewelry and watches in October and November.

Industry analyst Paul Zimnisky projected a 6% rise in global diamond jewelry sales to $84 billion in 2025, offering hope for an eventual market rebound.

3 months ago

25

3 months ago

25

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·