China's response to Trump's tariffs includes new restrictions on the export of critical elements. Effective immediately, exports containing strategic minerals have to apply for a Chinese Ministry of Economy export license, including details on their end use.

Painful Blow

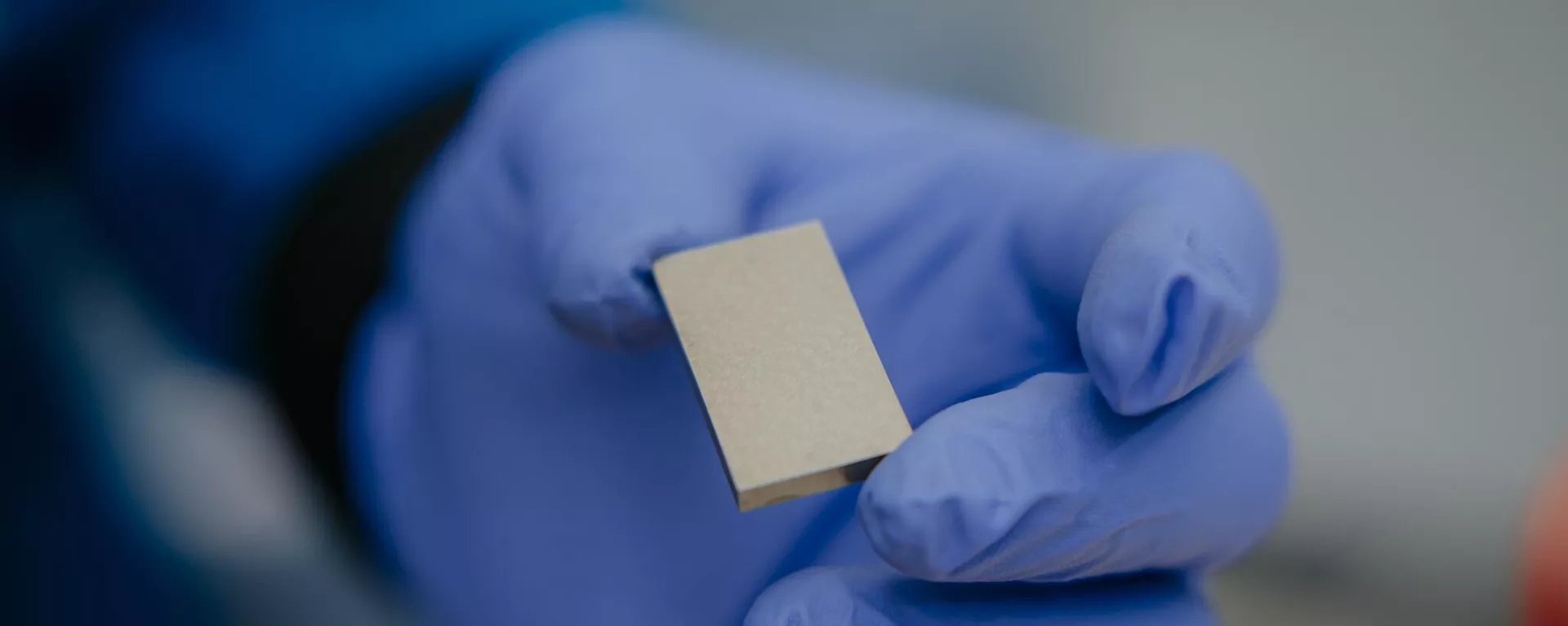

Gadolinium and dysprosium, two rare earths used along with zirconium in modern fuel assemblies, are an effective Chinese monopoly. 99% of their production is concentrated in a single plant outside Shanghai, Anpilogov says.

Installed assemblies at US plants will last 12-24 months, the expert estimates. After that, if the US can’t find new sources through third parties, the quality of its assemblies will drop.

No Alternative

Restoring production in the US would be extremely tricky, according to the observer.

“It’s a matter not of months, but of years, including construction, debugging of production, and tech adjustments.”

“The last lanthanide-separating centrifuge in the US was decommissioned in 1996. The people who worked on it are either retired, or you can read about their lives on a memorial plaque somewhere,” Anpilogov points out.

Boon to China’s Atomic Ambitions

The majority of the world uses 3 and 3+ gen reactor tech. Russia and China are currently the only ones widely experimenting with 4th gen reactors – including BN, Brest and SVBR, and an array of Chinese research reactors.

The rare earth restrictions response to US tariffs could allow China and Russia to “very seriously overtake the US," Anpilogov says.

That’s because along with Europe, America is stuck with third-gen reactors and cannot really produce replicable results on its 4th gen experimentation.

1 week ago

6

1 week ago

6

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·