"I’m not going to be out of sight or out of mind," Joe Biden quipped at one of his final conversations with reporters as president last week. He's not wrong. If the Treasury sanctions targeting Russian maritime oil exports succeed, Biden will remain in Americans' minds for a long time to come. But not for the reasons he might like.

The outgoing administration’s recent decisions suggest that their overarching goal is to create as many problems as possible for its successor in every area. This applies both to foreign policy, where a policy of

maximum escalation has been observed in virtually every

conflict zone, as well as the domestic front.

With mere hours now left in Biden’s term, the most effective tool in the waning days of his presidency has been sanctions, which can be quickly imposed but are difficult to revoke, given their political justifications.

"Today, the US Department of the Treasury took sweeping action to fulfill the G7 commitment to reduce Russian revenues from energy, including blocking two major Russian oil producers. Today’s actions also impose sanctions on an unprecedented number of oil-carrying vessels, many of which are part of the 'shadow fleet,' opaque traders of Russian oil, Russia-based oilfield service providers, and Russian energy officials," the Treasury

said in a press release last week announcing new sanctions against Russia's oil and gas sector.

"The United States is taking sweeping action against Russia’s key source of revenue for funding its brutal and illegal war against Ukraine," Treasury Secretary Janet Yellen said.

"This action builds on, and strengthens, our focus since the beginning of the war on disrupting the Kremlin’s energy revenues…With today’s actions, we are ratcheting up the sanctions risk associated with Russia’s oil trade, including shipping and financial facilitation in support of Russia’s oil exports," Yellen added.

But Team Biden's sloganeering about the sanctions' purpose being ‘continuing support for Ukraine’ is just cynical ideological cover for their true goal: disrupting the president-elect's plans, primarily in the economic and social sphere. As for hurting Russia, that won't work, and here's why.

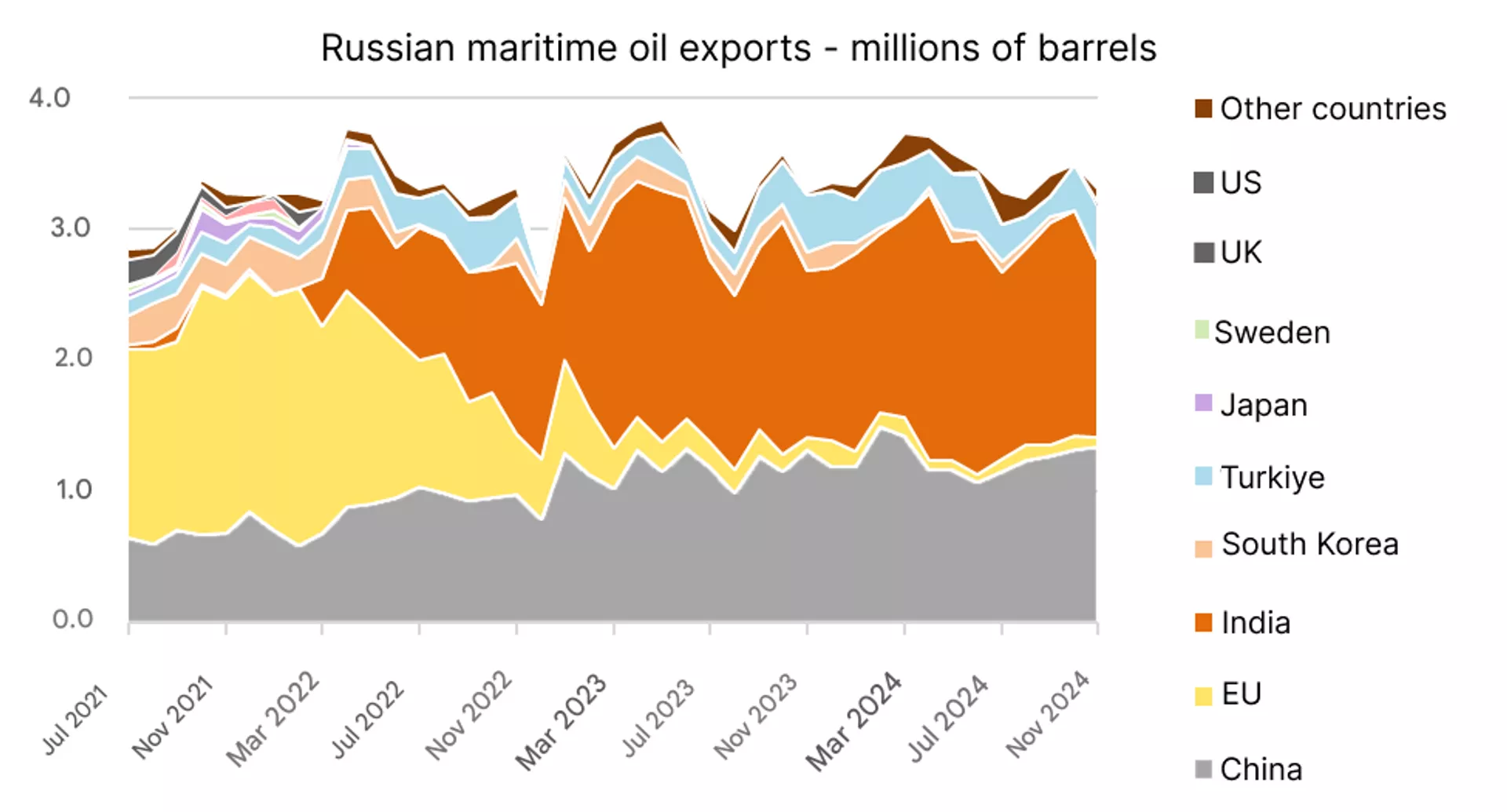

Russian Maritime Oil Exports: The Math

US sanctions will result in a significant bump in global oil prices, simultaneously offsetting the drop in production volumes by making up revenues into the Russian budget.

Russia’s maritime exports of oil and petroleum products amount to about

5.8 million barrels per day, of which

3.5 million barrels per day are crude oil.

Currently, global energy agencies and international banks predict a surplus in the oil market in 2025 averaging

0.8 million barrels per day.

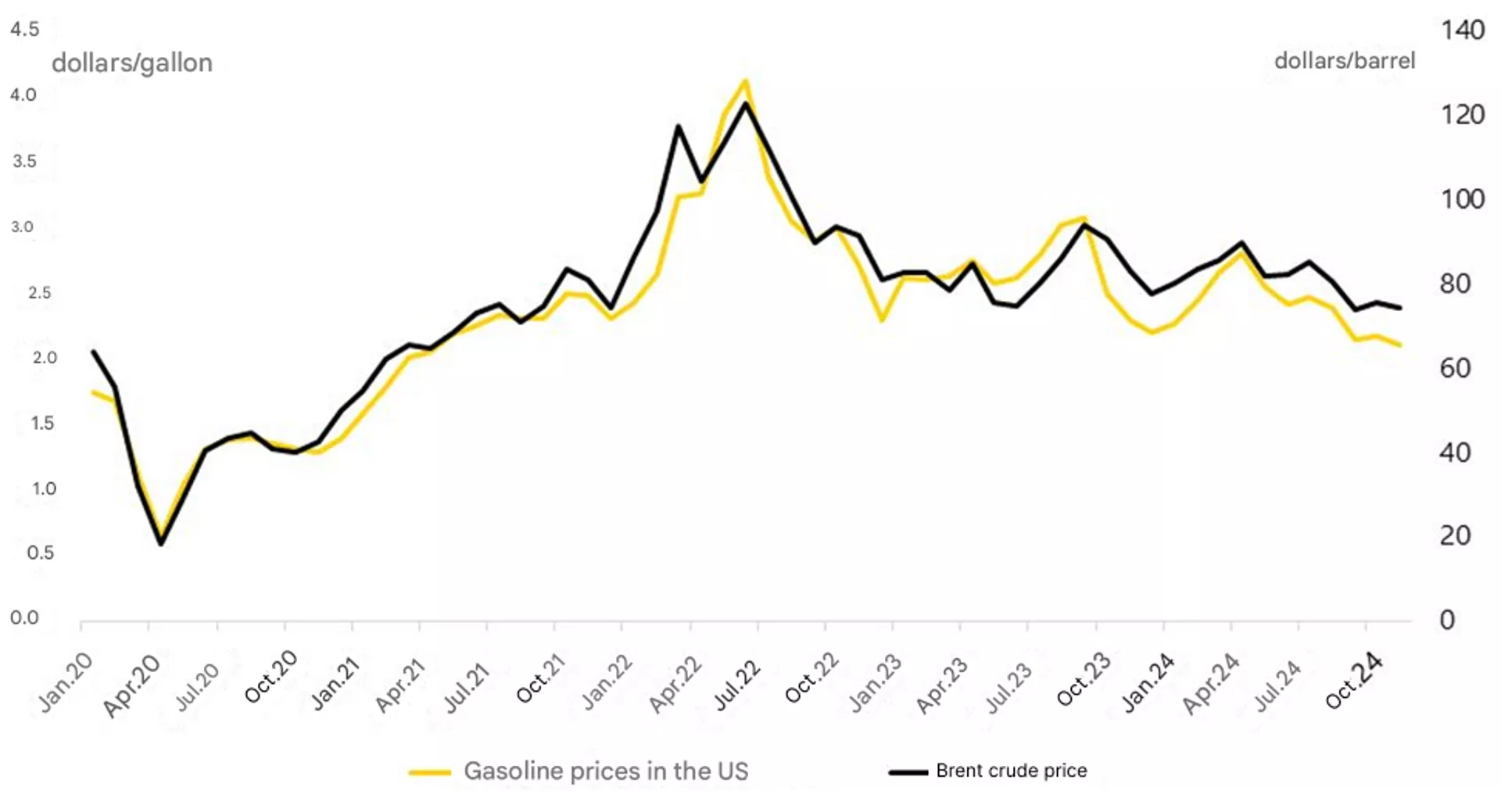

The consensus forecast for Brent crude prices in 2025 stands at

about $71 per barrel, according to major banks.

A complete halt to Russian maritime exports of oil and petroleum products (that is, a reduction in Russian oil production by that volume) would cause one of the largest-ever deficits in the global oil market in history (assuming oil production dynamics in other countries remain consistent with forecasts).

According to calculations by the Bank of America, based on historical data, a change in the supply-demand balance by 100,000 barrels per day results in an inverse change in oil prices by $1.50–$2 per barrel.

Consequently, the loss of such a significant volume of Russian exports (5.8 million barrels per day) from the global balance would lead to an increase in oil prices by $80–$90 per barrel, to $150–$160 per barrel.

The loss of far smaller amounts of Russian oil from the world market has already had devastating and immediate impact. In 2022, for example, when Russian oil and petroleum product exports dropped by

1.5 million barrels per day, oil prices rose to

over $120 per barrel.Crunching the numbers, with Brent crude priced at $158 per barrel, the export price of Russian oil for taxation purposes would be between $147 and $156 per barrel (depending on the size of the discount for Russian oil delivered via pipelines) compared to the roughly $70 per barrel assumed in the 2025 budget plan.

That means that under conditions of a full embargo on maritime oil exports, Russia's state budget revenues would increase (to $88.2 billion, compared to $82.3 billion under the current plan), despite a reduction in production and various associated costs.

It is highly unlikely that the United States would like to see such a scenario, as Middle Eastern countries currently lack sufficient spare capacity to replace lost Russian exports, and creating this capacity would require significant investments and time.

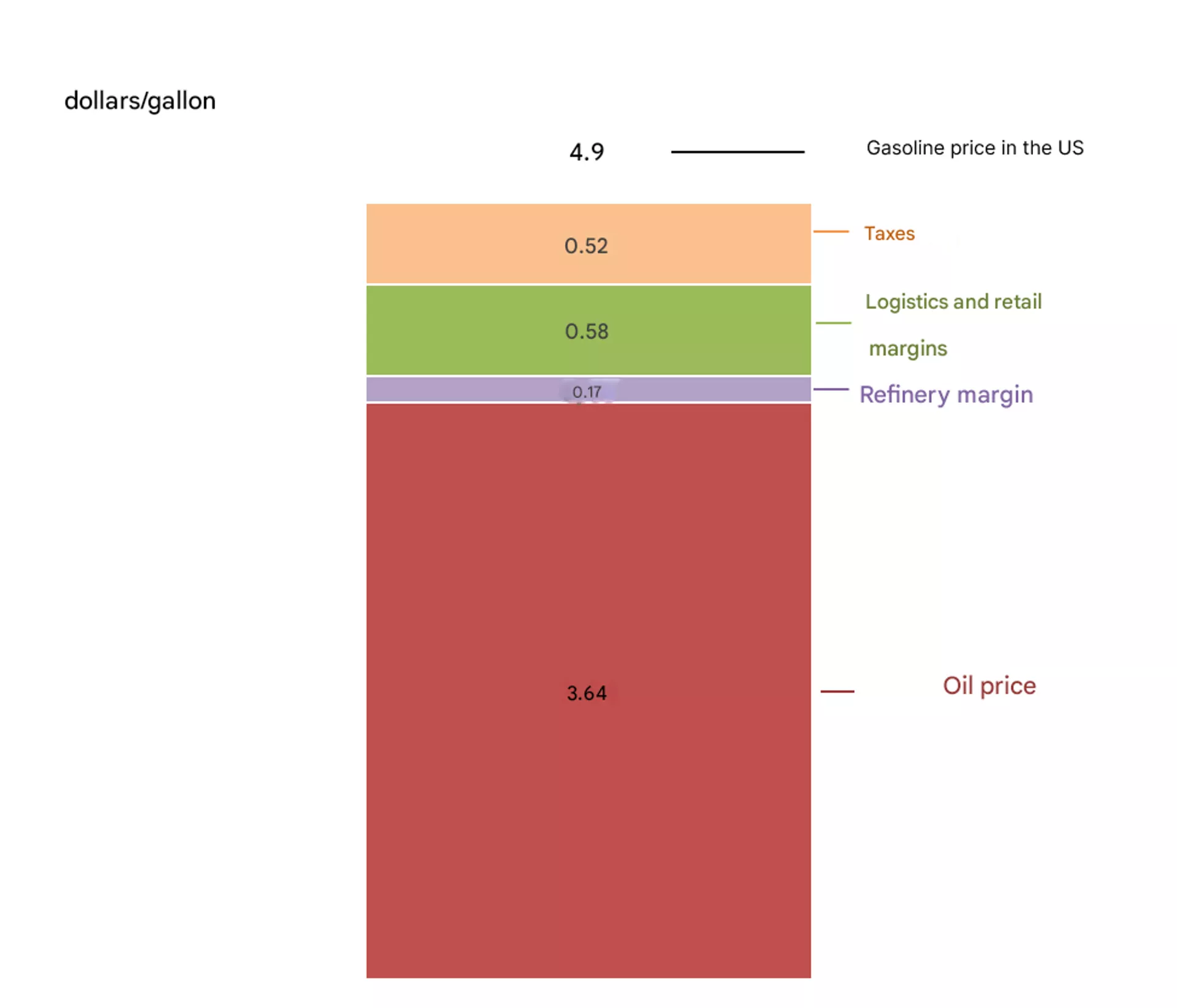

Consequences for Trump's MAGA Energy Plans

One of President-Elect Trump’s key campaign promises has been to turn the United States

into an oil superpower, and dominate global markets

by removing all barriers to production, thereby lowering the price of oil to

$50 per barrel or less.It's been assumed that this policy could serve as leverage against the Kremlin in negotiations over the terms of ending the conflict in Ukraine. However, it’s clear that Trump’s primary energy trump card is related to the anticipated growth in US global competitiveness, and the direct socioeconomic benefits lower retail fuel prices would entail for ordinary Americans.

Driving the point home that Biden's energy sanctions were aimed at Trump, rather than Russia, just five days before their announcement, the president

imposed what could be described as "anti-American" restrictions on energy by officially banning oil and gas drilling along the Atlantic and Pacific coasts of the United States.

Trump called the decision "ridiculous" and promised to "unban it immediately" after returning to the Oval Office.

What he does regarding the sanctions targeting Russian maritime oil sales, which this analysis has demonstrated will also harm the US, remains to be seen.

2 months ago

26

2 months ago

26

We deliver critical software at unparalleled value and speed to help your business thrive

We deliver critical software at unparalleled value and speed to help your business thrive

English (US) ·

English (US) ·